Ambetter From Sunshine Health Vs Florida Blue Hmo 2019

How much could you save on 2022 coverage?

Compare health insurance plans in Florida and check your subsidy savings.

Image: BlueOrange Studio / stock.adobe.com

Florida health insurance marketplace 2022 guide

Four health insurers joined the Florida marketplace for 2022; exchange enrollment hits record-high 2.7 million

- Louise Norris

- Health insurance & health reform authority

- January 31, 2022

Florida exchange overview

Florida utilizes the federally operated health insurance exchange – through HealthCare.gov. Fourteen carriers offer 2022 coverage through the state marketplace. During open enrollment for 2022 coverage, 2,723,094 Floridians enrolled in private individual-market plans through the Florida exchange.

Frequently asked questions about Florida's ACA marketplace

Florida uses the federally run exchange, so residents enroll through HealthCare.gov. Florida has the highest exchange enrollment of any state in the country, with more than 2.7 million people enrolling during the open enrollment period for 2022 plans — almost 19% of the entire country's exchange enrollments.

As of 2022, there are 14 insurers offering plans in Florida's marketplace, including four new insurers (new insurers are highlighted in bold type). As is the case in most states, insurer participation varies from one area of the state to another:

- AvMed

- Blue Cross Blue Shield of Florida (Florida Blue)

- Bright Health Insurance Company

- Capital Health Plan (new for 2022)

- Ambetter/Celtic

- Cigna

- Coventry/Aetna-CVS (rejoined the market for 2022, after exiting at the end of 2016)

- Florida Health Care Plan Inc

- Health First Health Plans

- Molina

- Oscar Health

- Florida Blue HMO (Health Options)

- Sunshine State Health Plan (new for 2022, also affiliated with Ambetter)

- UnitedHealthcare (rejoined for 2022, after exiting at the end of 2016)

Two insurers that offered plans in Florida's marketplace as of 2016 rejoined for 2022. UnitedHealthcare and Aetna CVS Health entered the Florida marketplace for 2022 (Aetna-CVS markets plans under the name Coventry). Two other insurers — Capital Health Plan and Sunshine State Health Plan — also joined the state's marketplace for 2022.

The state's existing marketplace insurers implemented the following average rate changes for 2022, which amount to an average rate increase of 6.6% (details available on ratereview.healthcare.gov):

(It's important to remember that these rate changes are calculated before subsidies are applied. Most enrollees qualify for subsidies, and that's particularly true for 2022. Especially for people who haven't checked their coverage options in a while, 2022 coverage might be much more affordable than expected)

- AvMed: 2.9%decrease

- Blue Cross Blue Shield of Florida (Florida Blue): 9.8% increase (only insurer with plans available statewide).

- Bright Health Insurance Company: 8.6% increase (coverage available in 15 counties in 2021, up from 13 in 2020).

- Cigna: 5.8% increase(coverage available in 11 counties, both on-exchange and off-exchange, for 2021; in 2020, plans were available in two counties on-exchange and 19 counties off-exchange).

- Florida Health Care Plan Inc:3.3% increase (FHCP is a subsidiary of Florida Blue)

- Health First Health Plans:2.2% increase

- Molina:6.5% increase (Molina's premiums decreased for the three previous years)

- Oscar Health:1.4% increase (coverage area increasing from 14 counties in 2020 to 24 counties in 2021).

- Florida Blue HMO (Health Options): 4.3% increase (plans offered in 50 counties for 2021, up from 46 in 2020).

- Ambetter (Celtic):9.9% increase (plans available in 63 counties for 2021, up from 30 in 2020).

- Sunshine State Health Plan: New for 2022, so no applicable rate change

- United Healthcare: New for 2022, so no applicable rate change

- Coventry/Aetna-CVS: New for 2022, so no applicable rate change

- Capital Health Plan: New for 2022, so no applicable rate change

For perspective, here's a summary of how average premiums have changed in Florida's individual market since ACA-compliant policies debuted in 2014:

- 2021: FLOIR announced that average premiums in the state's individual market would increase by 3.1% for 2021 (details for each carrier are available here). This was a larger overall increase than the insurers had initially proposed, but FLOIR clarified that the initial proposals had not included an adjustment to account for COVID-related costs. The insurers had later proposed an additional average increase of 2.8% for COVID, but the COVID factor that was approved by FLOIR amounted to an average increase of 2%, bringing the overall average increase to 3.1%. And AvMed, which previously offered plans only outside the exchange, is also offering on-exchange plans for 2021. And five of the existing exchange insurers expanded their coverage area in the exchange, adding additional counties where people can purchase coverage for 2021.

- 2020: FLOIR announced that the final approved average rate change in the individual market would be 0% for 2020 (insurers had initially proposed an overall average increase of 1.2 percent). There was significant variation from one plan to another however; some saw modest increases while others saw modest decreases. Bright Health joined the exchange, and Cigna rejoined after exiting a few years earlier.

- 2019: FLOIR published a list of the insurers that had filed to participate in 2019 (including Oscar, which joined the exchange as of 2019) and noted that the average proposed rate increase for 2019 was 8.8%. But after the rate approval process was completed, FLOIR announced that the final average rate increase would be just 5.2%. The average increase would have been even smaller — or perhaps even a decrease — if the Trump Administration and GOP lawmakers hadn't acted to destabilize the individual insurance markets (ie, if the individual mandate penalty hadn't been eliminated as of 2019, and if regulations hadn't been finalized to expand access to short-term plans and association health plans, both of which can be expected to siphon healthy people out of the ACA-compliant risk pool over time).

- 2018: Average increase of 44.8%, mostly due to the assumption (which was correct) that cost-sharing reduction funding would end. This is described in more detail below.

- 2017: Average increase of 19.1%.

- 2016: Average increase of 9.5%.

- 2015: Average increase of 13.2% (although a Commonwealth Fund analysis shows Florida marketplace premiums increased 7% on average compared to 2014 rates).

For 2014 and 2015, Florida's Insurance Commissioner was powerless to regulate proposed health insurance premiums, due to legislation signed into law by Governor Scott in 2013. But in 2015, for the first time since ACA-compliant plans debuted, Insurance Commissioner Kevin McCarty had the ability to challenge rates proposed by health insurance carriers. Since then, Florida's Insurance Commissioner has continued to regulate premiums in the state.

The basic details of the rate filings are available on the federal rate review site and on FLOIR's rate filing search system. But essentially all of the pertinent documents for each rate filing (ie, details about the rate changes and what's driving them, as well as enrollment numbers and coverage areas) are marked "trade secret" in Florida, and not available to view.

A record number of people – 2,723,094 enrolled in plans through the Florida exchange during the open enrollment period for 2022 coverage, which ran from November 1, 2021 through January 15, 2022. And that came on the heels of record-high enrollment in 2019, 2020, and 2021 as enrollment has continued to grow in Florida's marketplace. Florida's enrollment is by far the highest of any state, and accounts for almost 19% of the entire country's marketplace enrollments.

Nationwide, across all states that use HealthCare.gov, there was an average enrollment drop of about 5% in 2017, and roughly the same average drop again in 2018. But in Florida, 2017 exchange enrollment was 1% higher than it was in 2016. And although enrollment dropped in Florida in 2018, the decrease was smaller than the average across other HealthCare.gov states. It rebounded for 2019 to the highest level it had ever been, and then grew again, substantially, for 2020, 2021, and 2022.

Florida's exchange has led the nation in enrollment numbers ever since the exchanges began operation. Florida enrollment during previous open enrollment periods was as follows:

- 2014 coverage: 983,775 people enrolled

- 2015 coverage: 1,596,296 people enrolled

- 2016 coverage: 1,742,819 people enrolled

- 2017 coverage: 1,760,025 people enrolled

- 2018 coverage: 1,715,227 people enrolled

- 2019 coverage: 1,786,679 people enrolled

- 2020 coverage: 1,913,975 people enrolled

- 2021 coverage: 2,120,350 people enrolled (plus 542,067 enrollees during the COVID-related enrollment period in 2021)

- 2022 coverage: 2,723,094 people enrolled

As is the case in most states, insurer participation in Florida's exchange has changed considerably over time. Here's a summary:

Cigna exited at the end of 2015 (but planned to rejoin for 2020)

Two weeks before the start of the third open enrollment period, Cigna announced that they would not offer plans in the exchange in Florida in 2016. At that point, they had about 30,000 enrollees in the Florida exchange, all of whom had to select coverage from a different carrier if they wanted to continue to be insured in the exchange in 2016. Cigna continued to offer plans outside the exchange (and that's still the case as of 2019), but no subsidies are available outside the exchange.

In the weeks leading up to the start of open enrollment, there were carriers in several states that announced they would not participate in the exchanges for 2016. In most cases, the risk corridor payment shortfall was cited as a reason, but Cigna's justification for leaving the exchange was somewhat unique: the carrier cited fraudulent billing by substance abuse clinics and labs in Florida. Cigna has said they didn't realize how significant the fraudulent claims were until after the deadline to submit plans for 2016. Once they determined the scope of the problem, they made their decision to pull out of the exchange market for a year.

Cigna had planned to re-enter the Florida exchange in 2017 with a new suite of plans available. They filed rates in the spring of 2016, but ultimately withdrew their on-exchange plans, are have since only offered plans outside the exchange in Florida.

Time/Assurant exited at the end of 2015

Time/Assurant announced in June 2015 that they would exit the health insurance market nationwide and did not offer plans for 2016 or any subsequent years.

PMP was not allowed to offer plans as of 2016, due to financial concerns stemming from risk corridor shortfall

Preferred Medical Plan also exited the Florida exchange at the end of 2015, due to the risk corridor shortfalls that were announced in October 2015. With the lower-than-anticipated payments that carriers received through the risk corridors program, Preferred Medical Plan's was forced to pull out of the exchange. In December 2015, the carrier noted that "CMS has maintained its position that Preferred Medical Plan not be allowed to participate on the [ACA exchange] due to the funding shortfall created by CMS not paying the Risk Corridor payment." Preferred Medical Plan had about 75,000 Obamacare enrollees in 2015 in Miami-Dade and Broward counties, but they had to select new coverage for 2016

UnitedHealthcare exited at the end of 2016

UnitedHealthcare exited the individual market in Florida at the end of 2016, as was the case in many of the states where they offered exchange plans in 2016. As noted above, however, they are returning as of 2022.

Aetna exited at the end of 2016

Aetna also left the exchange in Florida at the end of 2016, as was the case in all but four of the states where they offered exchange plans in 2016. Aetna continued to offer off-exchange coverage in Florida's individual market in 2017, but exited the entire individual market at the end of 2017.

Humana reduced coverage area for 2017, exited entire individual market at the end of 2017

Humana scaled back their exchange participation across the country for 2017, and left the individual market as of 2018. They remained in the Florida exchange in 2017, but with a much smaller footprint. As of September 2016, Humana was planning to offer 16 plans in the Florida exchange, but no off-exchange plans. They exited 31 of the 38 counties where they offered plans in 2016, but continued to offer exchange plans in the other seven counties in 2017. However, Humana exited the individual market altogether, nationwide, at the end of 2017.

Celtic and Health First expanded coverage areas for 2018; Celtic expanded again for 2019 but Health First dropped back to four counties for 2019

Centene/Celtic/Ambetter already offered plans in the Florida exchange in 2017, but they expanded their coverage area for 2018. They offered plans in 17 counties in 2017, and that increased to 22 counties for 2018, with expansion into Alachua, Lake, Marion, Orange, and St. Lucie counties. And for 2019, Celtic is offering plans in 26 counties.

Health First offered plans in four counties in 2017, but covered five counties in 2018, with expansion into Seminole County. For 2019, they are back to four counties, offering coverage in Brevard, Flagler, Seminole, and Volusia counties (but no longer in Indian River County).

Molina, was considering whether to continue to offer coverage in the exchange in 2019, after losing a bid to renew their Medicaid managed care contract in Florida. Molina submitted plans for 2019 individual market coverage and simultaneously appealed the state's decision on the Medicaid contract. In June 2018, the state granted Molina a continued Medicaid contract in two regions of the state, in response to the insurer's appeal. And Molina's individual market plans continue to be available both on- and off-exchange coverage in 2019.

So for 2019, there were seven insurers in the Florida exchange, with the addition of Oscar Health. Oscar significantly increased its exchange footprint in 2019, including an expansion into Florida, Arizona, and Michigan, as well as coverage area expansions in some of the states where coverage was already being offered.

Insurer participation grew in 2020, 2021, and 2022

For 2020, Bright Health joined the exchange in Florida, and Cigna rejoined the exchange. And for 2021, AvMed joined the exchange, along with coverage area expansions for five existing exchange insurers. For 2022, four new insurers joined the exchange: Aetna-CVS/Coventry and UnitedHealthcare both rejoined after exiting at the end of 2016. And Capital Health Plan and Sunshine State Health Plan both newly joined the exchange.

The trend towards increased insurer participation since 2019 mirrors a national trend, as the individual market has once again become profitable, after significant financial losses in the early years of ACA implementation

Florida staunchly opposed the Affordable Care Act and the development of an ACA-compliant health insurance marketplace. Florida legislators not only failed to approve legislation to create an exchange in Florida, they returned a $1 million federal planning grant awarded in 2010. And right after the Supreme Court ruling that upheld most of the Affordable Care Act in June 2012, Republican Gov. Rick Scott announced that Florida would not establish a state-based health insurance exchange.

Florida also made it more difficult for navigators to assist consumers in using the marketplace. In 2013, Florida passed a law requiring fingerprinting and background checks for anyone who wanted to serve as a navigator. The state requirements were in addition to federal requirements for 20 hours of training and a qualification test.

Also in 2013, the Florida Department of Health (DOH) banned navigators from all county public health facilities. Florida DOH officials said the move was consistent with its policy of blocking outside groups not doing state business. They also said the ban protects consumers from privacy concerns stemming from the collection of personal information for inclusion in a federal database. The Obama administration strongly criticized the ban on navigators, labeling the order obstructionist and plain absurdity.

Florida has not accepted federal Medicaid expansion.

Would ACA subsidies lower your health insurance premiums?

Use our 2022 subsidy calculator to see if you're eligible for ACA premium subsidies – and your potential savings if you qualify.

Obamacare subsidy calculator *

Estimated annual subsidy

Provide information above to get an estimate.

* This tool provides ACA premium subsidy estimates based on your household income. healthinsurance.org does not collect or store any personal information from individuals using our subsidy calculator.

Legislation to end surprise balance bills took effect in 2016

On March 11, 2016, lawmakers in Florida passed House Bill 221, and Governor Scott signed it into law in April. HB221 banned the practice of balance billing in situations (including non-emergency care) where the patient uses an in-network hospital or urgent care facility and "does not have the ability or opportunity to choose a participating provider at the facility" (for emergency care, insurers are simply required to cover treatment at in-network rates, regardless of whether the providers are in-network, and there's no requirement that the patient not have been able to pick a different provider).

The new rules took effect July 1, 2016, and HB221 was lauded as a called a model for other states that wanted to implement similar consumer protections. The federal No Surprises Act took effect in 2022, providing nationwide protection from surprise balance bills. Although Florida already had HB221, state laws do not apply to self-insured group plans (which are regulated by the federal government under ERISA, and which cover the majority of the people who have employer-sponsored health coverage). So the No Surprises Act was beneficial in Florida because it filled in the gaps where state legislation didn't apply.

Florida already prohibited balance billing for HMO members who receive emergency care or treatment at an in-network facility, but HB221 provides similar protections for insureds who have PPO and EPO plans. HB221 was sponsored by six Republicans and two Democrats. Rep. Carlos Trujillo, a Miami Republican and one of the bill's sponsors, said that their goal was to "remove the consumer from the middle" of the billing process when hospitals contract with providers who aren't in the same networks as the hospital.

Balance billing had become increasingly common as health insurance plans offer narrower networks, and it put patients in the often impossible situation of needing to verify that every provider who would be treating them was in-network. Prior to HB221, it wasn't enough to verify that the facility and primary doctor are in-network; assistant surgeons, radiologists, anesthesiologists, and durable medical equipment suppliers may be out-of-network, and the patients may not even realize that those providers are treating them.

Not surprisingly, radiologists and anesthesiologists were among those fighting against HB221 in Florida, claiming that it would force them to accept whatever payment the insurance companies wanted to offer them, despite the fact that they don't have a contract with the carrier in question. But the legislation passed with support from both the Florida Association of Health Plans and the Florida Medical Association. (Various groups of medical professionals who tend to be out-of-network were also opposed to the federal No Surprises Act, but it also passed with bipartisan support.)

HB221 also requires hospitals to post names and links for providers who are in-network, and explain that the patient should take steps to ensure that treatment is being provided by in-network providers in order to avoid balance billing (note that HB221's ban on balance billing in non-emergency situations only applies when a patient is treated by a non-network provider at an in-network facility, AND the patient wasn't able to choose an in-network provider instead).

Florida's other exchange: 712 customers by 2016, no longer state-funded by 2017

Florida Health Choices is the state's own version of an online marketplace, but it does not offer any premium subsidies. While Florida Health Choices was established by 2008 legislation sponsored by Marco Rubio, who was the Florida House Speaker at that point, it faced many delays and did not go live until March 2014. The state's pseudo-exchange was engaged in a legal battle with HHS over efforts to trademark "Healthchoices, The Health Insurance Marketplace."

Florida Health Choices initially offered discount-only plans for some health services, such as dental services and prescription drugs. These plans were not true health insurance, and consumers largely ignored the state-sponsored exchange. Just 49 people purchased plans through Florida Health Choice during 2014 (by 2016, Florida Health Choices was no longer offering prescription discount plans, due to lack of consumer interest).

In early January 2015, Florida Health Choices began offering health plans that were compliant with the ACA and covered the ACA s ten essential health benefits. Policies from four insurers were available in 2015: Assurant, Cigna, Humana, and UnitedHealthCare.

For 2016, Assurant exited the health insurance market nationwide, but Cigna, Humana, and UnitedHeathcare continued to offer plans through Florida Health Choices (Cigna exited the Healthcare.gov exchange for 2016, but continued to participate in Florida Health Choices, which is technically "off-exchange").

For 2017, UnitedHealthcare exited the individual market in Florida, and their plans are no longer available on or off-exchange. Humana remained in some counties in Florida on HealthCare.gov, but dropped out of the Florida off-exchange market altogether, which means their plans were no longer available via Florida Health Choices.

Consumers who shop on Florida Health Choices can NOT obtain subsidies to help them pay for coverage. Those subsidies are available only through HealthCare.gov, the federally facilitated marketplace. As of 2018, 91 percent of Florida residents who had coverage through Healthcare.gov were receiving premium subsidies.

The Florida Health Choices board of directors approved an $852,000 budget for 2015. Heading into the year, Naff was quoted in the Miami Herald saying, "I'd be tickled pink if we got 1,000 people."

During the 2015 open enrollment period, 42 people bought health insurance plans through Florida Health Choices. By mid-April, it had 80 paying customers. During his unsuccessful 2016 presidential campaign, Marco Rubio distanced himself somewhat from Florida Health Choices, not mentioning it in his plans for repealing and replacing Obamacare.

By August 2015, Florida Health Choices had enrolled 150 people, and was reaching out to Realtors and professionals licensed by the state of Florida, offering them coverage through dedicated private exchanges. Naff noted that Florida Health Choices was aimed at people who earn too much money to qualify for premium subsidies, since those can only be obtained through Healthcare.gov in Florida. But Naff explained that Florida Health Choices could also help people enroll in Healthcare.gov if their income made them subsidy-eligible.

By mid-2016, Florida Health Choices had 712 customers, according to the Jacksonville Times Union. In order to be self-sustainable, they needed at least 3,000 customers, so they were still reliant on state funding. However, Governor Scott vetoed $250,000 in state funding for Florida Health Choices in the 2017-2018 budget, and Florida Health Choices is no longer supported by state funding. The state was working to sell the domain name in 2017, but it was still up as of 2018, with Florida Blue plans available. By 2019, the website was still up, but no plans appeared to be directly for sale through it.

2018 rates: Florida approved 44.7% average rate increases, mostly due to assumption that feds wouldn't fund CSR

In June 2017, FLOIR announced that six insurers planned to offer coverage in the Florida exchange for 2018, and that their combined proposed average rate increase was 17.8 percent. At that point, the rates that each insurer had filed were not yet publicly available, but it's important to note that those initial filings were based on the assumption that cost-sharing reductions (CSRs) would continue to be funded by the federal government in 2018.

Florida regulators asked insurers to file backup rates that would apply if CSR funding were to be eliminated, as rates needed to be considerably higher in that case. The backup rates are the ones that were ultimately approved by state regulators, as there had been no resolution to the CSR funding issue at the federal level by the time rates had to be finalized (in October, the Trump administration eventually did officially cut off CSR funding, so it was fortunate that Florida regulators had already approved the rates based on the assumption that would happen).

In addition, one Florida insurer's filing memo noted that "due to the exit of Aetna/Coventry from the [off-exchange] ACA market, FLOIR has required all carriers to increase rates by 3% so that rates are adequate to accommodate the migrating members."

Overall, the rates that Florida regulators approved represented an average increase of 44.7 percent. But FLOIR noted that 31 percentage points of that was "directly attributable" to on-exchange silver plans, which bear the increased premiums necessary to cover the cost of CSR. Not counting on-exchange silver plans, the average premium increase was 18 percent — still a significant increase, but not nearly as eye-popping as 44.7 percent.

People who have silver plans and who receive premium subsidies do not have to bear the burden of the CSR load on the silver plans, as premium subsidies are based on keeping the second-lowest-cost silver plan affordable, so they grew in 2018 to keep pace with the premium increases. 91 percent of Florida exchange enrollees were receiving premium subsidies in 2018, versus the nationwide average of 83 percent.

FLOIR noted that "consumers enrolled in a Silver on-Exchange plan that do not receive a premium subsidy will have the option of purchasing a similar off-Exchange Silver plan without this extra cost [of the added premium to pay for CSR]." On- and off-exchange plans have to have the same premium if they're identical, but if a slightly different off-exchange plan is offered, it wouldn't have to have the same premium, and could thus avoid the CSR load.

To fill in the backstory, CSRs are part of the ACA, and they allow low-income enrollees to have coverage with lower out-of-pocket costs if they pick silver plans. Sixty-four percent of Florida exchange enrollees were receiving CSRs in 2018 (versus 54% of exchange enrollees nationwide). But the ACA didn't specifically allocate funding for them, and House Republicans sued the Obama Administration in 2014 over the funding issue. The court sided with House Republicans in 2016, but the Obama Administration appealed and the money continued to flow to insurers until late 2017 (to the tune of about $7 billion in fiscal year 2017). The case was pended throughout 2017, but President Trump repeatedly threatened to cut off funding for CSRs, and his threats took on new urgency when the Senate failed to pass any version of their ACA repeal/replace legislation in late July (Nicholas Bagley has written an excellent explainer of how this all works).

Ultimately, the Trump Administration cut off CSR funding in October 2017. Insurers in most states, including Florida, added the cost of CSR to premiums (in most cases, only to silver plan premiums, as was the case in Florida). The result is larger premium subsidies for the 91% of Florida exchange enrollees who qualify for premium subsidies. For the 9% who aren't eligible for premium subsidies, the added cost of CSR could be avoided by selecting a non-silver plan for 2018.

2019 legislation: Weak pre-existing condition protections and elimination of Florida's modest restrictions on short-term plans

In 2019, Florida enacted legislation (S.322) that initially began as an effort to ensure that people with pre-existing conditions would have access to at least some health plans in the state's individual market if the ACA were to be repealed or overturned. But it was amended to include a provision that removed the state's existing (but fairly weak) limitations on short-term health plans.

And it also directed the state to consider whether it should modify its benchmark plan for essential health benefits under the flexibility that CMS now allows (all essential health benefits are still required to be covered; only six states, Illinois, South Dakota, Michigan, New Mexico, Oregon, and Colorado have thus far made modifications to their benchmark plans under the new rules). The Florida Office of the Insurance Commissioner analyzed the benchmark plans in other states compared with Florida's and ultimately recommended that no changes be made to Florida's benchmark plan.

S.322 does include a modest guaranteed-issue requirement that would take effect if the ACA were to be repealed or overturned by the Supreme Court. But it only requires each insurer to offer at least one guaranteed-issue plan, and there are no restrictions in terms of how much insurers could charge for that plan.

It's also noteworthy that Florida was one of the states that actively worked to get the ACA overturned in the Texas v. U.S / California v. Texas lawsuit. Together with 17 other GOP-led states, Florida argued that the ACA should be invalidated, and a judge agreed with them in late 2018. The case ultimately ended up at the Supreme Court, which upheld the ACA (for the third time) in a ruling that was issued in June 2021.

Oscar challenges exclusive agent clause in Florida, ultimately drops the suit

Oscar entered Florida's individual market in Orlando in 2019, and expanded to several other cities in 2020. Soon after the start of open enrollment for 2019 coverage, Oscar filed a lawsuit in an effort to eliminate Florida Blue's exclusive agent clause. In most markets, licensed insurance producers can be appointed with numerous insurers, offering their clients an array of plan options and helping them determine which one best fits their needs. But Florida Blue's contract with insurance agents requires them to be captive—they cannot sell other insurers' policies, and must only represent Florida Blue. And after Oscar entered the market in Orlando, Florida Blue required agents to sign new exclusivity contracts.

In describing this tactic, Oscar noted that "Florida Blue is using its monopoly power to make sure consumers do what's best for Florida Blue" (as opposed to doing what's best for the consumer).

Florida Blue acknowledged that they do indeed have an exclusive agent clause in their contracts, but defended it as a legitimate marketing strategy. Florida Blue claims that exclusive agent contracts are common, while Oscar says this "anti-consumer, anti-competitive" requirement is "exceedingly rare." For what it's worth, we're not aware of other big-name on-exchange insurers with captive agent clauses.

In April 2019, the US Department of Justice officially sided with Oscar. But although a captive agent clause is clearly at odds with the ACA's one-stop-shopping approach to individual market health insurance, HealthCare.gov's insurer contracts do not prohibit insurers from having captive agent clauses, and the website notes that while brokers represent multiple insurers, "agents may work for a single health insurance company," and both can provide assistance with enrollments through HealthCare.gov.

In September 2019, US District Judge Paul Byron dismissed Oscar's lawsuit (after ruling earlier in the year that Florida Blue could continue to use agents to sell policies while the case made its way through the legal system). Byron ruled that Florida Blue's exclusivity contract with agents is lawful and not coercive (Oscar and the Department of Justice had argued that it is coercive, as agents risk losing commissions and the ability to sell any of Florida Blue's lines of business statewide if they sell other insurers' plans in any areas of the state).

Oscar filed an appeal the following month, but ultimately dropped the case permanently in early 2021. So Florida Blue can continue to require its agents to only sell Florida Blue plans; these agents are not allowed to present their clients with any other plan options, even if another plan would be a better fit for the client's situation.

People in Florida can use an enrollment assister or a broker (HealthCare.gov's "find local help" tool can be used to show all brokers/agents and assisters who are certified with the exchange), but should be aware that if a broker is showing them Florida Blue plans, they might be missing out on seeing other options. And conversely, if a broker is showing them other options but not Florida Blue, they might need to contact a different broker or assister in order to see the Florida Blue plans.

Oscar enrolled 31,000 people in Orlando in 2019, and expanded into Daytona, Miami, Ocala, and Tampa for 2020. For 2021, Oscar expanded into ten additional counties, with plans available in a total of 24 counties. Florida Blue offers coverage statewide.

Grandmothered and grandfathered plans

Florida is one of the states that has allowed grandmothered/transitional health plans to remain in force through 2022. In October 2018, the Florida Office of Insurance Regulation (FLOIR) published a report indicating that there were still 151,605 people with transitional individual market coverage in the state—down from 236,701 in 2015.

Florida has also noted that more than half of the 523,000 people enrolled in small group plans in the state are covered under transitional small group plans. So the termination of transitional plans (if it's ever required to happen) would be more disruptive in the small group market than in the individual market (where the vast majority of enrollees are already covered under ACA-compliant plans).

Grandfathered plans can remain in force as long as the insurance company wants to continue to maintain them (some insurers have opted to terminate grandfathered plans, but they are not required to do so at any point, unlike grandmothered plans, which must terminate by the end of 2022, unless the federal government allows another extension, which appears likely given how many extensions have thus far been issued). 58,192 people were enrolled in grandfathered individual market plans in Florida as of 2017.

Florida health insurance exchange links

Other types of health coverage in Florida

Medicaid in Florida

Florida is one of the remaining holdouts to ACA's Medicaid eligibility expansion.

Medicare in Florida

More than half of Florida's Medicare beneficiaries are enrolled in Medicare Advantage.

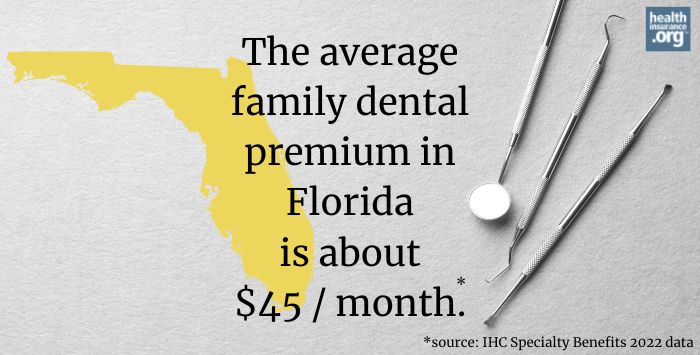

Dental Insurance in Florida

Learn about adult and pediatric dental insurance options in Florida, including stand-alone dental and coverage through the Florida marketplace.

ruckermovelledilly1971.blogspot.com

Source: https://www.healthinsurance.org/health-insurance-marketplaces/florida/

0 Response to "Ambetter From Sunshine Health Vs Florida Blue Hmo 2019"

Post a Comment